Nvidia Earnings - AI Flywheel Accelerates

Why Nvidia Remains the Single Most Important Company in AI

When I introduced my "AI Flywheel" framework in early April, Nvidia sat squarely at the intersection of massive secular tailwinds: AI applications driving cloud infrastructure expansion, which in turn fuels demand for specialized AI chips. Last night’s Q1 FY-26 earnings report and call reinforced Nvidia’s dominant role in this virtuous cycle, validating its status as the essential pick-and-shovel play in the unfolding AI era.

Blackwell Delivers: Headline Numbers at a Glance

Nvidia’s Q1 FY-26 numbers came in exceptionally strong:

Total Revenue: $44.1 billion (+69% Y/Y)

Data Center Revenue: $39.1 billion (+73% Y/Y)

Networking Revenue: $5.0 billion (+64% Q/Q)

Operating Cash Flow: $27.4 billion (+79% Y/Y)

These impressive figures were delivered despite significant headwinds from China, including export restrictions that resulted in a $4.5 billion write-down and approximately $2.5 billion of unfulfilled orders. Without these China-related setbacks, Nvidia’s reported numbers and its outlook would have been even stronger.

The enormous operating cash flow allowed Nvidia to return $14.3 billion to shareholders this quarter alone, with buybacks annualizing around 1.7% of its current $3.4 trillion market cap. Notably, share-based compensation was only $1.4 billion. In a market where dilution from tech companies is often the norm, Nvidia’s disciplined capital allocation stands apart. Simultaneously, Nvidia is building its net cash position (up from $43 billion to $54 billion).

Reasoning AI Drives Explosive Demand Growth

CEO Jensen Huang captured the quarter succinctly, noting that "AI inference token generation increased ten-fold year-over-year," driven by the shift towards reasoning and multi-step agentic models. The newly launched Blackwell NVL72 GPU, described by Huang as a “thinking machine,” has seen remarkable uptake: hyperscalers are now deploying nearly 1,000 NVL72 racks weekly (equivalent to roughly 72,000 GPUs).

Simultaneously, the networking business is flourishing, with NVLink 5 surpassing $1 billion in sales in its initial full quarter and Spectrum-X now annualizing above $8 billion. These results underscore Nvidia's entrenched role not just in silicon, but also in the critical infrastructure binding AI clusters.

Margins Shine Amid China Challenges

Nvidia’s gross margins continue to impress with an adjusted gross margin of 71.3% (excluding the H20-related write-down). Management's guidance indicates further expansion towards mid-70% margins by year-end as the higher-margin Blackwell products become a larger revenue share.

The ongoing China restrictions also impacted Nvidia’s forward-looking guidance. The company incorporates another $8 billion revenue shortfall from China in its Q2 outlook. Nevertheless, Nvidia’s robust overall guidance ($45 billion ±2%) highlights the resilient and diversified nature of global AI demand.

AMD Still Trailing by a Wide Margin

What about the competition? AMD reported data-center growth of +57 % Y/Y, reaching $3.7 billion. Impressive—until you recall that this is only ~9 % of Nvidia’s $39.1 billion. Nvidia’s own data-center line grew +73 % Y/Y, so the gap is actually widening.

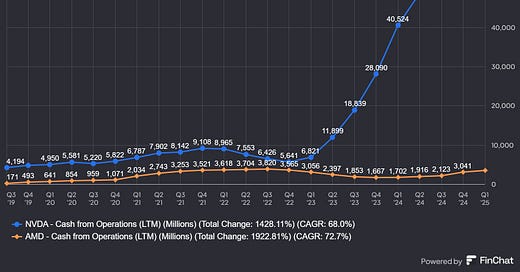

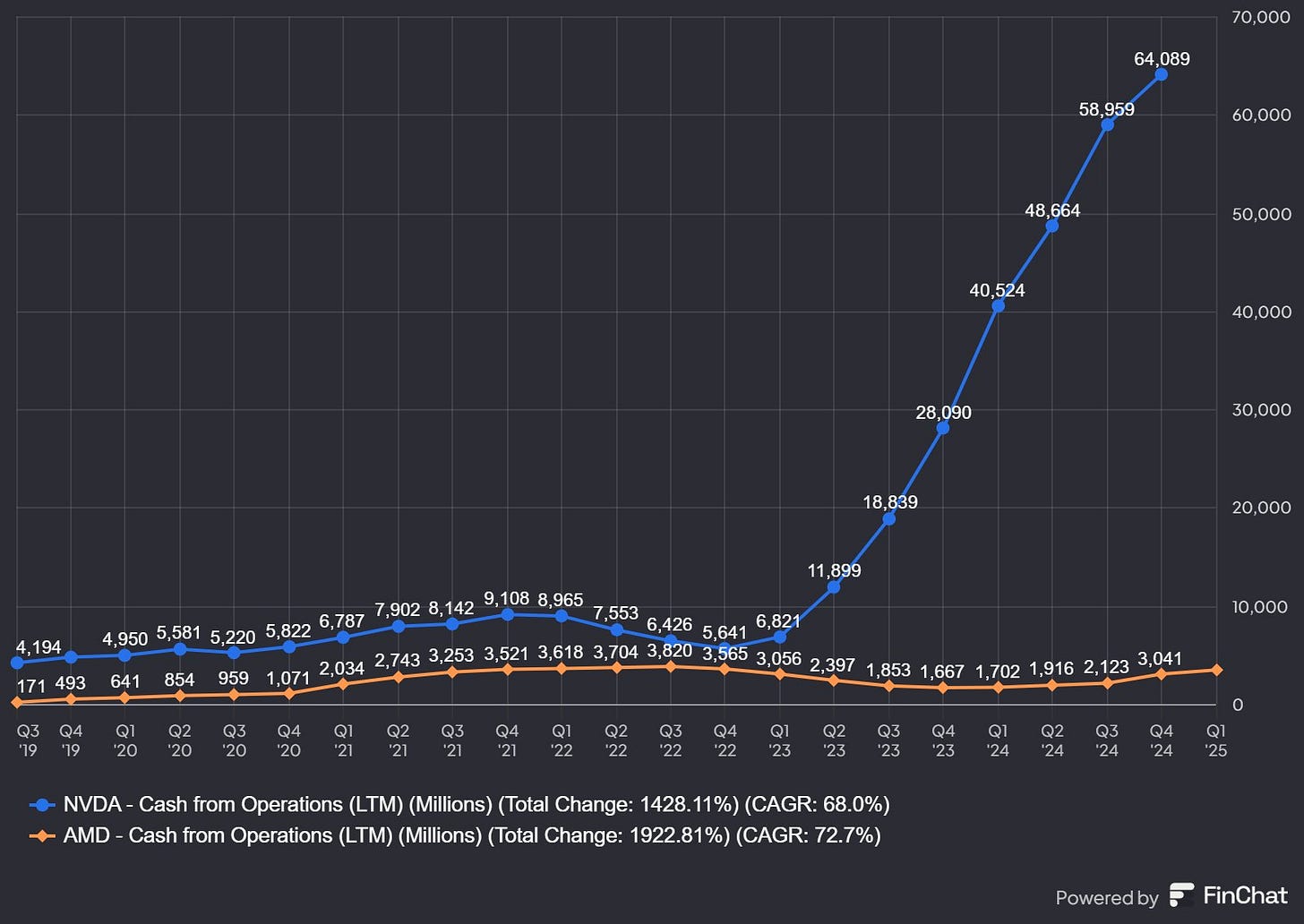

To me, Nvidia’s expanding dominance is a strong hint for the existence of a substantial competitive moat. Nvidia’s dominance is also clearly visible in its cash flows vs AMD.

Company Strategy: Sovereign AI & Enterprise AI

In the earnings call, CEO Jensen Huang highlighted sovereign AI as a strategic growth engine:

Every nation now sees AI as core to the next industrial revolution, a new industry that produces intelligence and essential infrastructure for every economy. Countries are racing to build national AI platforms to elevate their digital capabilities. At COMPUTEX, we announced Taiwan's first AI factory in partnership with Foxconn and the Taiwan government. Last week, I was in Sweden to launch its first national AI infrastructure. Japan, Korea, India, Canada, France, the U.K., Germany, Italy, Spain and more are now building national AI factories to empower start-ups, industries and societies. Sovereign AI is a new growth engine for NVIDIA. - CEO Jensen Huang at the Q1 2026 earnings call.

Moreover, Nvidia is increasingly emphasizing on-prem Enterprise AI:

The foundations of our next growth platforms are in place and ready to scale. Sovereign AI, nations are investing in AI infrastructure like they once did for electricity and Internet. Enterprise AI, AI must be deployable on-prem and integrated with existing IT. Our RTX Pro, DGX Spark and DGX Station enterprise AI systems are ready to modernize the $500 billion IT infrastructure on-prem or in the cloud. Every major IT provider is partnering with us. Industrial AI from training to digital twin simulation to deployment, NVIDIA Omniverse and Isaac GR00T are powering next-generation factories and humanoid robotic systems worldwide.

The age of AI is here from AI infrastructures, inference at scale, sovereign AI, enterprise AI and industrial AI. NVIDIA is ready. - CEO Jensen Huang at the Q1 2026 earnings call.

To put a final exclamation mark on the quarter, the following Jensen Huang quote in my view perfectly captures where the AI flywheel is headed:

The pace and scale of AI factory deployments are accelerating with nearly 100 NVIDIA-powered AI factories in flight this quarter, a twofold increase year-over-year, with the average number of GPUs powering each factory also doubling in the same period. And more AI factory projects are starting across industries and geographies. NVIDIA's full-stack architecture is underpinning AI factory deployments as industry leaders like AT&T, BYD, Capital One, Foxconn, MediaTek, and Telenor, are strategically vital sovereign clouds like those recently announced in Saudi Arabia, Taiwan and the U.A.E. We have a line of sight to projects requiring tens of gigawatts of NVIDIA AI infrastructure in the not-too-distant future.

The transition from generative to agentic AI, AI capable of perceiving, reasoning, planning and acting will transform every industry, every company and country. We envision AI agents as a new digital workforce capable of handling tasks ranging from customer service to complex decision-making processes.

Nvidia has once again reinforced its indispensable role within the AI ecosystem. In this transformative decade, Nvidia continues to embody exactly what investors should seek: robust growth, capital efficiency, and durable competitive advantages.

Valuation and Positioning

At roughly 28 × next‑twelve‑month earnings—and retiring nearly 2 % of its shares each year via buybacks—Nvidia still stands out as the single most compelling way to own the AI infrastructure story. Acting on that conviction I have doubled my position from 2.5 % to 5 %, funding the move by fully exiting my 2.5 % stake in AMD. Even at 5 %, I’m still under the S&P 500’s 6.2 % Nvidia weighting. In my view, investors should think hard about whether they wish to underweight what is arguably the most important company of the AI revolution.

(As always, this is my research notebook—not investment advice. Do your own due diligence!)