Investing in the Age of AI

After nearly three months of work, I'm very glad to share that my article, "Investing in the Age of AI," is finally out. The goal of this article is to present my framework for investing during what is likely to become an incredibly disruptive decade. AI will change almost everything, and investors should ensure they don't find themselves on the losing end of this disruption. While indexing might be a reasonable approach, I believe we can do better. There are currently a few gems available in the market—wonderful businesses with very long growth runways—that I believe have high probabilities of becoming standout winners of this era, available at what appear to be very reasonable prices.

I hope you will enjoy some of the insights.

Disclaimer: This writeup is not investment advice and should not be construed as such. I am sharing my research insights and positioning on individual companies for informational and entertainment purposes. In particular, I do not take into account any readers personal financial situation. Please do your own research.

1) The Age of Artificial Intelligence is Here

A Breakthrough Moment

When I first experimented with ChatGPT in late December 2022, I immediately realized we were experiencing a historic inflection point. By spring 2023, I joined the chorus on X noting that ChatGPT’s initial release was more than just impressive—it marked a fundamental breakthrough. Even as advancements continued, the original launch stood apart, making subsequent improvements feel incremental by comparison.

While debates persist about the arrival of Artificial General Intelligence (AGI)—AI capable of human-level reasoning—it’s clear that large language models have dramatically reshaped how we access and use knowledge.

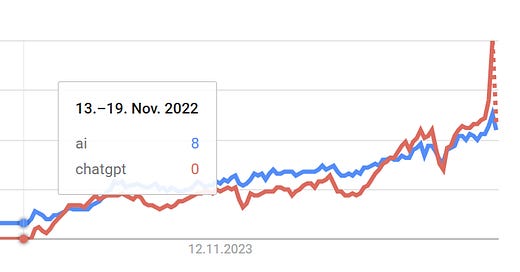

Fast forward just over two years, and the term "artificial intelligence" dominates global conversations, reflecting a profound shift in public interest and daily headlines about AI breakthroughs.

From Buzzword to Verb

Perhaps even more remarkable is how closely "ChatGPT" aligns with this broader AI trend. As the Google Trends graph below demonstrates, "ChatGPT" has essentially become synonymous with artificial intelligence, showcasing its widespread cultural impact and visibility:

Today, "ChatGPT" isn't just a product name—it's now part of everyday language, used frequently as a verb in the same way "Google" once entered our lexicon. People commonly say they'll "ChatGPT" a topic, signaling just how essential the tool has become for quick insights, explanations, and ideas.

The Billion-User Race

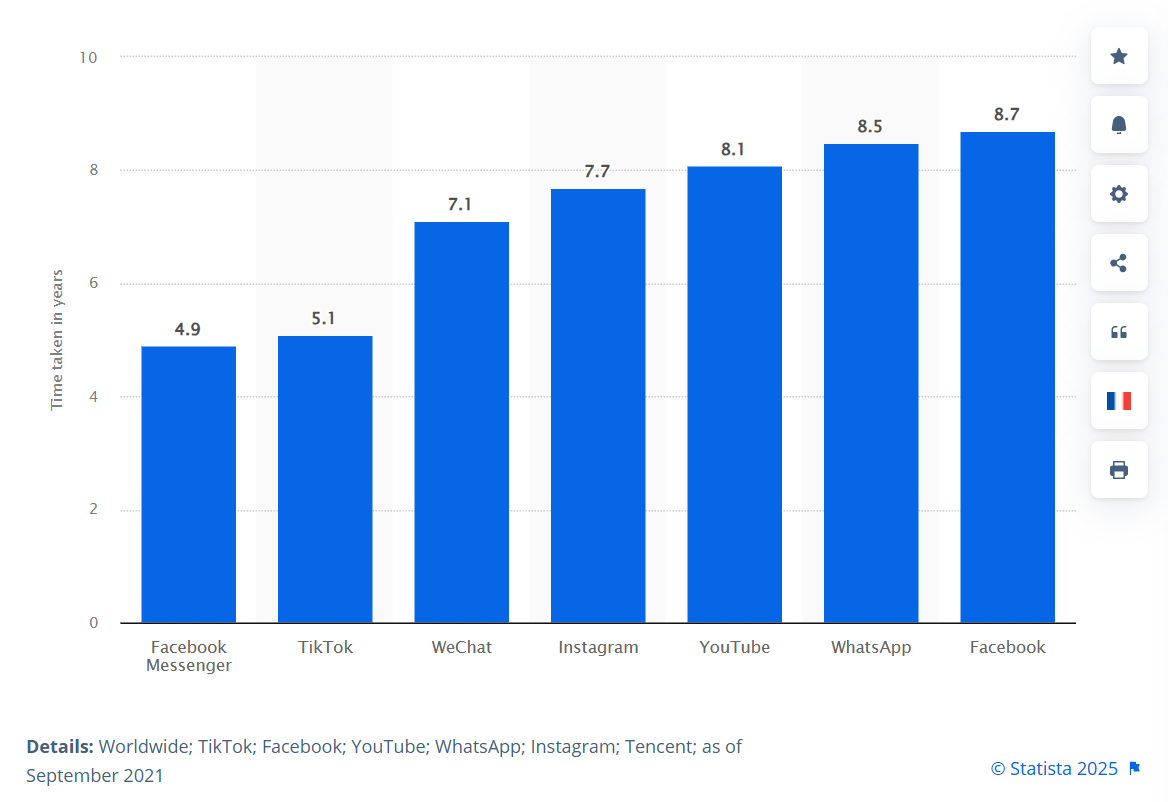

With over 500 million weekly active users by March 2025, ChatGPT’s growth trajectory is nothing short of astonishing. Its rapid adoption stands apart because it's purely organic, driven solely by the exceptional utility and appeal of its core service. At its current pace, ChatGPT is poised to become one of the fastest products ever to reach a billion users—a milestone previously achieved by platforms like Facebook Messenger primarily due to their extensive pre-existing user base.

As of early April 2025, ChatGPT ranked number one in iOS app downloads in 16 of the world’s 20 largest economies. Notably, it consistently topped charts even in culturally and linguistically diverse markets such as Japan, South Korea, and Indonesia. This unprecedented global appeal illustrates ChatGPT’s unique ability to transcend geographic and linguistic barriers.

On April 1st, OpenAI’s Sam Altman revealed that the platform added one million new users within a single hour. This data point to me suggest that ChatGPT still remains in the steep part of the user adaption S-Curve. It thus seems only a matter of time until ChatGPT reaches the 1 billion user milestone.

Why Everyone Should Care

Understanding ChatGPT isn’t merely interesting—it's essential. To fully understand what all the buzz is about, I can only recommend to deeply engage with ChatGPT yourself, be it for entertainment (creating pictures or making anime versions of family photos), for informational purposes, or to get coaching for how to finish a marathon etc. I can highly recommend Andrej Karpathy’s youtube video on how he uses LLMs (including ChatGPT but also others):

Even as someone who has been extensively using AI tools over the past few years, I still found myself taking notes. Karpathy, a former AI director at Tesla and now at OpenAI, offers an exceptionally clear, hands-on overview of current LLM capabilities, revealing powerful insights and practical techniques that even advanced users might miss.

This video is also important to understand why AI will matter more and more for investors: Watching the video, it is easy to see how a knowledge worker like Karpathy is basically co-working with an LLM all day. This is also the case for me, and my prediction is that this will increasingly be the future for the majority of knowledge workers globally.

As of today, I would describe the current most important strengths and use cases of large language models (LLMs), or the chatbots such as ChatGPT through which we interact with them as follows:

Current Strengths and Use Cases of ChatGPT and LLMs:

Knowledge: Instant access to summarized, comprehensive information. (Example: Instantly explaining complex events like the 2008 financial crisis.)

Coding: Rapid creation, debugging, and automation of programming tasks. (Example: Automatically generating Python web scrapers.)

Reasoning: Structured problem-solving and logical conclusions. (Example: Advising on investment strategies in specific market scenarios.)

Creativity & Brainstorming: Idea generation, overcoming creative blocks, and diverse perspectives. (Example: Quickly generating marketing slogans or creative story ideas.)

But why does it matter for investors? Because the box of pandora has been opened and there is no way back: AI is already profoundly reshaping how we work and how productive we are. Billions of knowledge workers are about to figure out how AI use can improve their workflows. While this process will take years or even decades to fully play out, the next phase of AI adoption is already beginning: The full automation of some workflows. While this disruption could lead to job losses initially, it will also free up time and energy for humans to create value in other ways, which will ultimately grow GDP. This principle has made humanity richer and richer over the centuries, but now it seems we have reached a tipping point. Nevertheless, the ride will be bumpy and the distribution of gains will be very uneven, so I believe this a topic of utmost importance for every investor - in terms of both, which companies will win, and which companies will lose from the unstoppable advent of AI.

2) How AI is Already Transforming Workflows

Dylan Field, CEO of Figma, summarizes the transformative power of AI as follows:

"AI lowers the floor of entry into specialized domains while significantly raising the productivity ceiling." (Dylan Field, CEO of Figma)

This insight highlights AI’s twofold impact: it empowers novices to engage with previously inaccessible fields, while simultaneously enabling experts to achieve unprecedented productivity.

Accelerated Productivity and Higher Quality Outcomes

Tasks once requiring hours—like synthesizing reports, writing code, or generating creative content—are now achievable in minutes. This allows teams to tackle more ambitious projects within the same timeframe and at a higher standard.

Recent examples include:

A Swedish study found that AI-supported breast screening detected 20% more cancers while reducing human workload by 44% (Lang et al., 2024).

Another recent study showed that AI significantly improved ovarian cancer diagnosis accuracy (86.3%), surpassing even expert performance (82.6%) (Epstein et al., 2025).

Automating Repetitive Tasks

AI handles repetitive or technical tasks, enabling workers to focus on higher-value activities. For example:

Google Cloud CEO Thomas Kurian highlighted how AI agents are revolutionizing customer service by managing queries, upselling products, and significantly improving efficiency (Evans, 2025).

Goldman Sachs CEO David Solomon noted that AI could complete 95% of an S-1 filing in just minutes, dramatically streamlining financial workflows (Fortune, 2025).

Democratizing Access and Opportunity

Generative AI is dramatically improving education and access to expertise globally, especially in underserved communities. A notable case is a World Bank pilot in Nigeria where generative AI accelerated student learning equivalent to two years of progress in just six weeks—outperforming 80% of other interventions (De Simone et al., 2025).

These workflow transformations aren’t merely incremental improvements—they are reshaping competitive advantages and creating new markets, making them highly relevant for investors. Businesses leveraging AI effectively today will define industry standards tomorrow.

3) Whats Next for AI? From Narrow AI to Superintelligence

Artificial Intelligence is rapidly evolving from narrow, specialized applications toward Artificial General Intelligence (AGI)—systems capable of performing any cognitive task at human-level proficiency. Beyond AGI lies Artificial Superintelligence (ASI), AI that surpasses human cognitive abilities across all domains, representing a transformative leap forward.

Visionary Predictions on AGI and ASI by Tech Leaders

Here are key recent statements from influential leaders on the trajectory toward AGI and ASI:

Sam Altman (CEO, OpenAI) – Jan. 5, 2025, personal blog “Reflections”: “We are now confident we know how to build AGI as we have traditionally understood it. We believe that, in 2025, we may see the first AI agents ‘join the workforce’ and materially change the output of companies.”Altman added that OpenAI is “turning our aim beyond [AGI], to superintelligence” and is “here for the glorious future,” envisioning superintelligent AI that could “massively increase abundance and prosperity”

Demis Hassabis (Co-founder & CEO, Google DeepMind) – Mar. 17, 2025, DeepMind press briefing: Hassabis predicted that “over the next five to ten years we should start seeing… artificial general intelligence,” referring to AI with human-level cognitive abilities. AGI could help cure diseases and solve the energy crisis, profoundly transforming medicine and energy sectors.

Elon Musk (CEO of Tesla; Founder, xAI) – Apr. 8, 2024, X (Twitter) Spaces interview: “If you define AGI… as smarter than the smartest human, I think it’s probably next year, within two years,” Musk said, predicting that AI could surpass the best human intelligence by 2025–2026.

Bill Gates (Microsoft Co-founder) – Early 2025, interview (Indian Express): Gates painted a vision of personal AI assistants for everyone. “You know, we will all have an agent that will be a utility helper to get things done… your agent will determine which parts of that are important enough for you to spend time understanding,” he explained, predicting ubiquitous AI “agents” managing our tasks and priorities. Gates also noted that within a decade “great medical advice [and] great tutoring” will become free and commonplace thanks to AI, solving shortages of doctors and teachers.

Eric Schmidt (Former CEO, Google) – Sept. 25, 2024, interview at Stanford: “In 3–5 years, AI may equal the sum of human intelligence, which will change ‘everything, everywhere, all at once’ in ‘unimaginable’ ways,” Schmidt predicted. He argued this impending change is “underhyped, not overhyped,” urging people to recognize how a true collective-human-level AI could rewrite society in the near future.

Dario Amodei (CEO, Anthropic) – Jan. 2025, Wall Street Journal at Davos: Amodei told an audience at WEF that he is “relatively confident” AI will surpass human intelligence in the next two or three years. He predicted AI models will be “better than almost all humans at almost everything” within 2–3 years, eventually exceeding all human capabilities even in robotics. This optimistic timeline from the Anthropic chief underscores his view that artificial superintelligence could emerge before 2028.

These insights from industry leaders signal a consensus that AGI—and potentially superintelligent AI—are imminent, bringing not only profound implications for humanity, but also substantial investment opportunities through incremental advancements.

Near Term: AI Agents as Autonomous Productivity Accelerators

A critical development to watch closely in 2025 is the emergence of AI agents—systems autonomously managing complex tasks without continuous human oversight. Unlike traditional generative models, AI agents interact dynamically with their environments, handling sophisticated workflows independently.

Key deployments by major technology firms include:

OpenAI's "Operator":

An autonomous AI agent managing digital workflows, system maintenance, and software development tasks. Described by Sam Altman as a "giant breakthrough" reshaping professional productivity (Robison, 2024).

Alphabet's Gemini 2:

Capable of autonomously managing tasks like scheduling, financial decision-making, and complex web interactions. Sundar Pichai highlights these agents' strategic thinking capabilities as productivity enhancers (Knight, 2024).

Microsoft's Expanded "Copilot" Platform:

Integrated AI agents autonomously generating business insights, performing financial analyses, and streamlining communications within Microsoft 365 and Dynamics. Jared Spataro (Microsoft AI at Work) refers to these agents as a "paradigm shift" in workplace productivity (Ray, 2024).

The economic implications of widespread AI agent adoption are transformative, promising significant productivity enhancements. Companies adopting AI agents early will likely achieve substantial competitive advantages, while late adopters risk falling behind. This dynamic creates substantial investment opportunities, but also necessitates vigilance as entire industries adapt or face disruption.

In the next section, I will try to quantify the economic opportunities presented by these advancements.

5) Economic Implications: AI’s Growing Share of Global GDP

Projecting GDP in 2035

This section aims to quantify the economic value that artificial intelligence may create globally over the next decade. I am here referring to the entire scope of incremental impacts—from boosting productivity among knowledge workers and fully automating routine service tasks, such as call centers, to automating entire business processes. Additionally, significant value will be unlocked through advances in robotics, autonomous vehicles, and intelligent agents capable of independently managing complex workflows.

In 2024, global GDP was $110 trillion according to the IMF. The IMF data shows that historically, the global economy has grown at an average annual rate of 5.2% since 1980, though with considerable variability across decades: growth averaged 3.9% per year in the 1990s, surged to 6.9% in the 2000s, slowed to 2.5% in the 2010s, and has reaccelerated to around 4.6% annually over the last five years. Looking forward to the next 10 years until 2035, I consider three plausible growth scenarios: a conservative estimate at 2.5% per year, matching the lower pace of the 2010s; a more optimistic midpoint at 3.5%; and an ambitious scenario of 4.5%, reflecting a robust global expansion facilitated by significant AI-driven productivity gains. This optimistic scenario would still show significantly lower growth than the post dotcom era in the 2000s.

Using my base case scenario of 3.5% growth p.a., global GDP would reach about $155 trillion in today's dollars by 2035—or approximately $188 trillion when accounting for a moderate inflation rate of 2% per year.

Projecting the AI-Share of GDP in 2035

Admittedly, forecasting the AI-share of global GDP has the highest forecasting uncertainty. It will depend on how optimistic one is about the capabilities of AI today and by how much they will further improve in the future, and of course by how much companies and knowledge workers will adapt it. The competitive nature of markets leads me to believe that adoption of AI technologies will be as strong as the merit of the technology allows. In addition, the AI-share of GDP will depend on further technological breakthroughs in robotics, autonomous driving, etc. I believe these breakthroughs are obvious to anticipate, but it remains uncertain as to when they will occur and by when they will have achieved significant user adoption.

Despite these considerable uncertainties, I would like to offer my current best guess on this topic. While the range of potential outcomes is wide, I have a pretty high conviction that at the very least the low end of my scenarios, which is a 5% AI-share of Global GDP will materialize. Importantly, even this conservative scenario would have enormous investment implications.

To clarify, in this exercise I am not speculating about the incremental share that AI may contribute to GDP. Instead, my aim is to quantify the total share of GDP that will be executed by or with the help of AI. This view importantly includes current share of GDP done by humans that will be replaced by AI or by humans that are more efficient in conducting tasks with the assistance of AI. In my view, this perspective will better capture the investment implications of the AI opportunity. Of course, any human potential and energy that is freed up because tasks are taken over by AI will be readily available to contribute in other, new forms (and be it by becoming Yoga teachers or spiritual counsellors), which would likely lead to an increase in GDP. This was the process of technological innovation that has lead to the wealth of nations.

Masayoshi Son has shared an intriguing perspective on the economic potential of AI. Speaking at the Future Investment Initiative, Son estimated that scaled-up AI technologies could add approximately 5% to global economic output by 2035. He described this 5% contribution as a conservative estimate (I agree), suggesting that the actual impact could be higher.

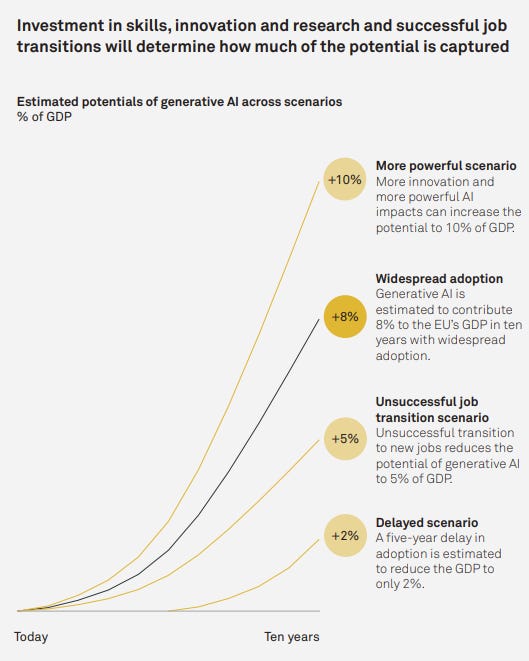

A study released in September 2024 by Implement Consulting Group offered the following scenarios focusing on generative AI. At a midpoint, they see just generative AI (i.e. excluding robotics, autonomous driving etc) at an 8% share of global GDP 10 years from today.

If we go beyond generative AI, I believe it is realistic to assume a 10% share of global GDP as a realistic midpoint estimate.

Another study from September 2024, released by IDC projects that AI-driven economic activity could generate an additional $19.9 trillion in global GDP by 2030, representing about 3.5% of the world's total economic output. If we linearly extrapolate the 3.5% share accumulated over 5 years, we would end up at 7.0% after 10 years, similar to the Implement Consulting Study.

Basedon these studies, a current best guess scenario for the AI-share of GDP in 2035 would be about 7.5%. At a 2035 GDP of $155 trillion (3.5% growth), this would imply a $11.6 trillion AI-share of world GDP in today’s USD, or a $14.1 trillion opportunity if we assume 2% inflation. Notably, from an investment perspective, this would be the potential incremental annual value creation by AI workloads, whether or not they lead to incremental GDP.

The table below sums up key inputs to arrive at my estimate of $11.6 trillion AI-share of global GDP (or $14.1 trillion in 2035 dollars).

Yet, even these midpoint or optimistic estimates may ultimately prove to be significant underestimations. History demonstrates that technological breakthroughs—like electricity, the internet, or mobile technology—often dramatically surpass initial projections, reshaping economies in unforeseen ways. Given the accelerating pace of AI advancement, Ibelieve there remains a meaningful "tail risk" to the upside: AI’s impact on global GDP could considerably exceed even our most optimistic current forecasts, profoundly altering economic dynamics and creating opportunities we can scarcely imagine today.

Investment Implications

If the AI-share of global GDP reaches $14.1 trillion by 2035, this implies annual AI-driven revenues or cost savings of that magnitude. With the current S&P 500 net profit margin at around 12%, a conservative assumption is that AI-driven revenue gains or cost savings achieve a similar margin. Under this assumption, incremental annual earnings generated by AI could amount to approximately $1.69 trillion. Using a price-to-earnings ratio of 25x (reflecting above-average long-term growth prospects driven by AI), these incremental earnings alone would justify an additional global market capitalization of roughly $42 trillion by 2035.

To put this into context, the entire market capitalization of the S&P 500 was about $50 trillion as of March 31, 2025. At a forward P/E ratio of 20x, the expected earnings for the year 2025 amount to around $2 trillion. Thus, the potential incremental market value created by AI in just ten years approaches the current total market value of the S&P 500 today.

Naturally, these substantial AI-driven economic benefits will not be confined solely to U.S. companies or Big Tech. In my view, the vast majority of AI-driven gains will be broadly distributed across the global economy, as companies of all sizes and sectors integrate AI technologies into their operations, enhancing productivity, quality, and efficiency.

The rise of AI arguably strengthens the case for index investing more than ever before. While AI will unquestionably create significant aggregate economic value, it will also sharply intensify competitive pressures. This "survival-of-the-fittest" environment means roughly half of all companies could significantly outperform the other half. Even companies simply defending their positions will need to invest continuously in AI just to avoid falling behind—a phenomenon known as the Red Queen Effect, named after Lewis Carroll’s character who explained that continuous adaptation is required just to maintain one’s relative position.

Even within my own portfolio, there will inevitably be laggards ("lemons"), and vigilance will be essential to quickly identify and replace these with future AI winners.

Beyond this broad market-level perspective, certain sectors and even specific companies already appear exceptionally well-positioned to capture outsized shares of AI-driven value creation. In the following section, I outline the sectors and companies that I believe will play pivotal roles in capturing the immense potential of AI.

6) The “AI Flywheel” - Where is AI-Value Creation Most Likely to Accrue?

At the heart of understanding AI’s economic potential is recognizing the existence of a powerful, self-reinforcing positive feedback loop, which I term the "AI Flywheel." Unlike negative feedback systems, which tend to stabilize around equilibrium (such as real estate markets, where excess supply naturally corrects itself by reducing prices and discouraging further development), positive feedback loops accelerate growth through self-perpetuating cycles. For instance, if cloud computing infrastructure becomes oversupplied, the resulting price drop actually stimulates demand by making AI model training cheaper, enhancing model quality and affordability of applications. This drives broader adoption, further increasing cloud computing demand—a virtuous cycle distinct from typical negative-feedback market dynamics.

My AI Flywheel illustrates three core, mutually reinforcing layers:

1) AI Applications

AI applications—including ChatGPT, Google's Gemini, Amazon Robotics, and Waymo autonomous vehicles—represent the front line of AI value creation. These applications directly boost productivity, automate tasks, and introduce new services, creating immediate and visible economic benefits. Each improvement attracts more users, generates additional data, and feeds back into increasingly capable AI models.

2) Cloud Infrastructure

All powerful AI applications rely heavily on scalable cloud infrastructure provided by AWS, Microsoft Azure, and Google Cloud. As AI applications become more widespread and sophisticated, they drive substantial growth in demand for cloud computing resources. Increased cloud capacity and competition lower costs, facilitating even more intensive AI model training and deployment, reinforcing continued demand growth.

3) AI Chips

At the base of the Flywheel are advanced AI-specific chips produced by industry leaders such as Nvidia, AMD, ARM, and semiconductor fabs like TSMC. These specialized chips enable training and operation of more complex AI models at increasingly efficient scales. Rising cloud infrastructure utilization fuels heightened demand for these chips, incentivizing continuous technological advances and production scaling, making chips more powerful and cost-effective.

Implications of the AI Flywheel

The positive feedback loop at the heart of the AI Flywheel has profound implications. Unlike traditional markets that naturally stabilize around equilibrium, the AI system continuously accelerates its own growth. Even if attempts are made to "slow down" AI development, powerful economic incentives will strongly counteract such efforts. Ultimately, every business process and economic layer that can be meaningfully improved or automated by AI will undergo transformation. If, in 10 years, AI’s share of GDP reaches 7.5%, this will mark only the beginning of a much larger, ongoing economic transformation.

Consider automating a call-center role costing around $10,000 annually per employee in Southeast Asia. Initially, if AI operation costs about $9,000, companies might hesitate. However, breakthroughs like DeepSeek dramatically reducing annual costs—potentially to $3,000—make automation irresistible. This scenario illustrates Jevons' Paradox, where increased efficiency (lower AI operating costs) doesn't merely reduce expenses—it drastically increases total AI adoption and utilization.

Based on everything we currently understand, I am convinced that the AI revolution will surpass all previous technological shifts, including the industrial revolution—both in scale and impact.

For investors, the critical question becomes how to best position oneself to capture this historic opportunity. As previously discussed, index investing could be a straightforward solution, as it ensures exposure to all potential winners, offsetting the inevitable losers in a scenario likely to be strongly net-positive. However, as a value-focused investor, I prefer actively seeking exceptional opportunities and avoiding companies that appear vulnerable. For example, Apple—the largest component of the S&P 500 with a 6.67% weighting—is not only exposed to challenges from the ongoing tariff conflicts but is also, in my view, poorly positioned for the AI-driven future. Apple is vulnerable to competitors developing truly personalized AIs with deep integration into users' personal data. Despite these risks and having the lowest growth among its Big Tech peers, Apple currently trades at the highest P/E ratio, reinforcing my cautious stance.

In the following subscriber-only section, I outline my current positioning regarding specific AI-related investments and explain the rationale behind each holding.

7) My AI Portfolio and Investment Rationale