Sea Limited

The cash cow, the core, and the optionality - How Sea's share price can compound at a CAGR of 24% for the next decade.

Summary

Singapore-based Sea Limited ($SE) operates across three business segments: Digital Entertainment (Garena), E-commerce (Shopee), and Digital Financial Services (Sea Money). After the share prices dropped -90% from 2021 highs, the current share price may offer a very attractive entry price. Sea Ltd is on track to deliver more than $2 billion in adjusted EBITDA in 2023. With a current market capitalization of $22 billion and $3 billion in net cash, Sea Ltd currently trades at a valuation of just ~10x EBITDA. Using a sum of the parts valuation, I consider Sea Ltd significantly undervalued, offering significant upside for the patient long term investor.

Valuation Approach

In this writeup I am using a sum of the parts valuation approach to value Sea Ltd. Based on the most recent financials, I am offering my estimates for the 2023 financials for each of Sea’s business segments. I will then provide a current value estimate using industry comps. Moreover, I will share my current assessment of the long term growth and margin potential of Sea, as a basis to estimate potential long term returns.

1) Garena the Cash Cow - Sea’s Digital Entertainment Business

Garena is the digital entertainment arm of Sea Limited and is one of the leading online game developers and publishers in the global gaming industry. Garena is the developer behind "Free Fire", one of the most downloaded mobile games worldwide. "Free Fire" has been particularly popular in emerging markets due to its compatibility with a wide range of devices, including lower-end smartphones.

"Free Fire" is a globally recognized mobile battle royale game. In each quick 10-minute match, players are dropped onto a secluded island to compete against 49 others, all striving to be the last person standing. Participants decide where to land with their parachutes and must remain within a safe area to endure. They can use vehicles to traverse the expansive map, take cover in nature, or stay hidden by lying low in grass or trenches. The primary objective is simple: outlive others and fulfill the mission's demands.

Beyond "Free Fire", Garena has a history of licensing hit games from other developers and localizing them for Southeast Asian and Taiwanese audiences. Garena's platform provides a social environment for players, including chat functions, live streaming, and an ecosystem that encourages user engagement. Moreover, Garena is a prominent esports organizer, hosting events worldwide, from local tournaments to globally recognized professional competitions. The strong community that Garena has nurtured around its games keeps players engaged and can be considered a moat.

Monetization

Garena monetizes its games primarily through the sale of virtual items and in-game currency. "Free Fire", for instance, offers a wide variety of in-game purchases that enhance the gaming experience.

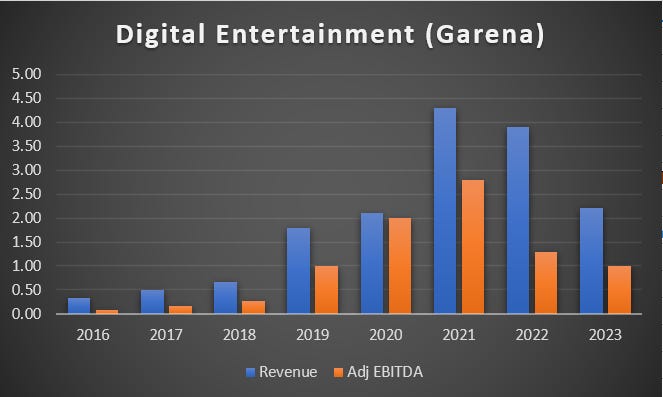

Digital Entertainment Revenue and EBITDA

Garena has benefitted tremendously from the Covid shutdowns. Revenues and EBITDA significantly ballooned between 2020 and 2021. As the world reopened, the gaming business naturally gave back some wins, as can be seen by the revenue and EBITDA deceleration in 2022 and 2023. Moreover, Free Fire was hit by a government crackdown on a long list of games in India in February 2023. Interestingly, Free fire was just allowed to relaunch in India, which should bring back some 40 million monthly active users back on the platform.

In its Q2 2023 report, the gaming segment already showed signs of stabilization. Adjusted EBITDA was $240 million, up 4.1% from Q1 23. With the return of free fire in India, I expect that Sea’s digital entertainment business will achieve at least $1 billion in adjusted EBITDA in 2023.

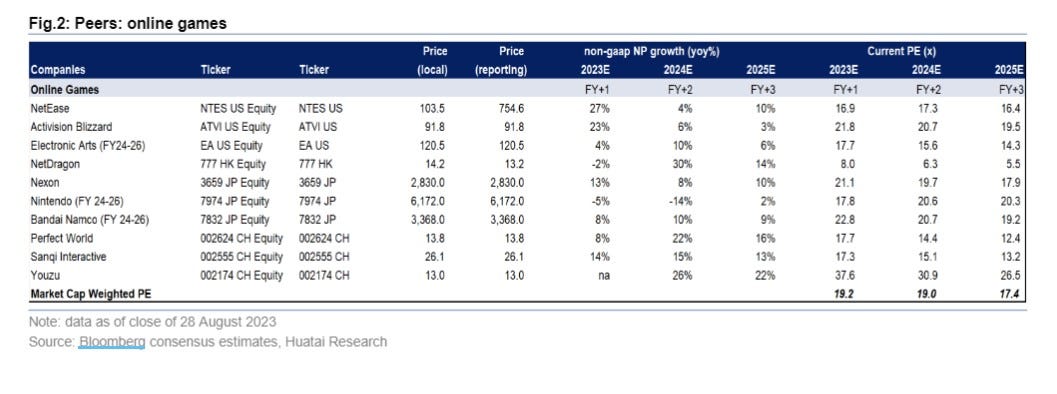

Current Valuation of the Digital Entertainment Business

Global gaming peers currently trade at 19.2x 2023 earnings. I am aware that EBITDA is not equal to free cash flow, but since Sea is free of (net) debt, there is no material interest and in the case of a gaming operation there is also no material depreciation. I thus value Sea’s digital entertainment business at 15x adjusted EBITDA for 2023, which results in a current valuation of $15 billion. If the net cash of $3 billion is added, the gaming business alone almost justifies the current total market capitalization of Sea Ltd.

Long Term Potential of the Digital Entertainment Business

For the next years, I anticipate that Garena revenue and EBITDA stabilizes at current levels. At this point, in my base case scenario, I thus anticipate neither significant growth, nor further deceleration from the Covid years. This leaves some room for upside surprise if the segment delivers a new gaming hit. But it could of course also come worse.

I prefer to take a long term view when analyzing investments. Based on my current assumption, I am modelling a future value for the digital entertainment business of $15b, assuming 15x EBITDA valuation by 2033 on $1b in annual EBITDA by then.

If my base case assumption is correct, the digital entertainment business will throw off $1 billion in EBITDA per year. The cash flow could finance the growth in Sea’s other business segments. Alternatively, the cash flow could be used to buy back shares or buy other games. In my opinion, share buybacks would make a lot of sense at the current share price. But the current market environment is rather uncertain, so I have understanding if the company prefers to play it safe at this point. With the current level of interest rates, the cash holdings yield significant interest income. In the 6 months of 2023, Sea generated $150m in interest income, which should grow further in the second half of the year, given recent interest rate developments.

2) Shopee the Core - Sea’s E-Commerce Business

Shopee: A Dominant Player in Southeast Asia's E-Commerce Landscape

Overview: Shopee, a part of Sea Ltd, is a leading e-commerce platform in Southeast Asia. It offers a diverse range of products, catering to a wide consumer base.

Strong Regional Footprint: Shopee has established a formidable presence in key Southeast Asian markets, including Indonesia, Vietnam, Thailand, and the Philippines, capitalizing on the region's growing internet penetration and digital economy.

Localized Approach: A significant moat for Shopee is its deep localization strategy. This includes local language interfaces, tailored product ranges, and partnerships with regional sellers and brands, making it highly appealing to local consumers.

Mobile-First Strategy: With a mobile-centric approach, Shopee addresses the high mobile usage in Southeast Asia. Its app is designed for ease of use on smartphones, a primary internet access point in the region.

Integrated Ecosystem: Shopee benefits from Sea Ltd's broader ecosystem, including SeaMoney (digital financial services) and Garena (digital entertainment), which help drive traffic and enhance user engagement.

Robust Logistics and Payment Infrastructure: Shopee has developed strong logistics and payment infrastructures to support its operations, offering reliable delivery services and multiple payment options, crucial in a region with diverse logistics challenges and payment preferences.

Aggressive Marketing and Promotions: Shopee invests heavily in marketing and promotional activities, including mega shopping events and celebrity endorsements, to attract and retain customers.

Strong Seller Support: By providing tools and services to support sellers, including small and medium enterprises, Shopee has built a loyal seller base, contributing to its diverse product offerings.

Data-Driven Insights: Leveraging data analytics, Shopee offers personalized shopping experiences and optimizes its operations, from inventory management to customer service.

Competitive Landscape: Despite intense competition from other e-commerce platforms, Shopee's localized content, user-friendly interface, and strong logistics network give it a competitive edge in Southeast Asia.

Shopee's success in Southeast Asia is a testament to its strategic focus on localization, mobile accessibility, integrated services, and robust support for both buyers and sellers. This positions it well to capitalize on the region's growing e-commerce market.

Q2 2023 Profitability:

In the second quarter of 2023, Shopee demonstrated substantial underlying profitability of its ecommerce business, especially in Southeast Asia. Its GAAP revenue was $2.1 billion, up 20.6% year-on-year. The core marketplace revenue rose by 37.6%, driven by increased ad uptake and commission rates. Adjusted EBITDA for the e-commerce segment turned positive, recording $150.3 million, a significant improvement from a $648.1 million loss in Q2 2022, with the Asian markets alone accounting for an adjusted EBITDA of $204.1 million.

Q3 2023 Return to Growth:

In Q3 2023, Shopee's GAAP revenue was $2.2 billion, a 16.2% increase year-on-year. The core marketplace revenue, comprising transaction-based fees and advertising revenues, rose by 31.7% year-on-year to $1.3 billion. Gross orders and GMV also showed strong growth, indicating a robust return to growth in this period.

Revenue: Increased by 16.2% year-on-year to US$2.2 billion.

Core Marketplace Revenue: Grew by 31.7% to US$1.3 billion, driven by transaction-based fees and advertising revenues.

Gross Orders and GMV: Orders increased by 13.2% year-on-year to 2.2 billion; GMV grew by 5.1% to US$20.1 billion.

Market Analysis: In Brazil, the contribution margin loss per order improved significantly by 90.7% year-on-year.

Long Term Potential of Sea’s Ecommerce Business

I believe the Q2 2023 results have been pivotal for Sea Ltd. They have revealed the underlying profitability of the e-commerce business for a stage where Sea no more invests into heavy growth for its ecommerce business. Adjusted EBITDA for the Asian markets was $204 million on $2.1b in total revenues. Given the losses outside Asia, in particular in Brazil, I believe that Shopee at scale can produce EBITDA margins of about 15%.

For 2023 I anticipate Shopee revenues of $8.7b. For the next decade I anticipate that Shopee can grow revenues at a CAGR or about 14% per year. This would result in ecommerce revenues of $31.5b by 2033, and an adjusted EBITDA of almost $5b per year. Valuing the Ecommerce business at 3x sales in 2033, or 19x EBITDA, would result in a future valuation of the ecommerce business of $91b by 2033.

3) SeaMoney - Sea’s Digital Financial Services Business

SeaMoney, operates as a digital payments and financial services provider in Southeast Asia. Its business model revolves around offering a range of financial products and services that cater to the needs of consumers and small businesses. This includes digital payment solutions and credit offerings, such as consumer loans and financial services tailored for e-commerce transactions on the Shopee platform. By leveraging technology, SeaMoney aims to enhance the financial accessibility and convenience for users across its markets, underpinning Sea's mission to better lives with technology.

SeaMoney generates revenue primarily through its financial services, which include digital payment processing and credit offerings. The digital payments segment earns fees from transactions processed on its platform, including those made on the Shopee e-commerce platform. Additionally, the credit segment of SeaMoney, which includes consumer loans and buy-now-pay-later services, generates revenue through interest and fees charged on the loans it extends to consumers and small businesses. This diversified revenue model, combining transaction fees and financial charges, allows SeaMoney to capitalize on the growing digital economy in Southeast Asia, where there is increasing demand for convenient digital financial services.

Q3 Results for SeaMoney:

Revenue: Jumped by 36.5% year-on-year to US$446.2 million.

Adjusted EBITDA: Improved significantly to US$165.7 million from a loss of US$(67.7) million in Q3 2022.

Loan Portfolio: Gross loans receivable increased by 5.3% to US$2.4 billion, with a reduction in non-performing loans to 1.6%.

Sea money currently operates at a 37% adjusted EBITDA margin and is producing an annualized $662.8 in adjusted EBITDA per year.

Long Term Potential of Sea’s Digital Financial Services Business