Re-Accelerating in the Cloud - Can Alibaba Compound 20% in the AI Decade?

While Alibaba is a household name in the investment community, it is arguably among the harder to understand businesses due to its complexity and diverse business segments. This analysis aims to assess Alibaba’s fundamental value, by focusing on its three core pillars: the foundational Taobao and Tmall marketplaces, its strategic stake in Ant Group, and its increasingly important Cloud Intelligence unit. It is the cloud division in particular, with its accelerating strength in recent quarters, that positions Alibaba as a compelling and potentially underappreciated AI play for the decade ahead. As this opportunity is currently available at a valuation of just 11x forward earnings, I explore what it takes for Alibaba to compound at a CAGR of 20%.

Disclaimer: This write-up is for informational purposes only and is not investment advice.

Business Segment Overview

The following table breaks down Alibaba’s EBITA by segment and Income from Operations for the financial year ended March 31, 2025:

It is easy to see that the vast majority of operating income results from the Taobao and Tmall Group segment. The only other meaningful contributor is the Cloud Intelligence Group, which has also demonstrated phenomenal EBITA growth of 72% in 2025. Aside from that only the Cainiao segment provided positive EBITA.

Notably, Alibaba’s 33% non-controlling stake in ANT is not included in this table. Instead, ANT is accounted for as an equity-method investment, so Alibaba records ANT under one net number called “Share of results of equity-method investees” after operating profit.

Valuation Approach

In this writeup, I am going to focus on the following three core components of Alibaba’s value: 1) Taobao and Tmall Group, 2) Cloud Intelligence Group, and 3) the value of Alibaba’s stake in ANT.

Since the other segments apart from Cainiao are currently loss making, I am not going to attribute a value to them. This raises the question how to allocate firm level expenses. I am going to subsume all unallocated expenses, share based compensation, and taxes under the Taobao and Tmall segment. This approach is conservative, as it likely understates the true value of Taobao and Tmall.

At the same time, attributing zero value to all currently unprofitable segments may be harsh. After all, the international e-commerce segment includes major players such as AliExpress, Lazada, and Trendyol, which as a group grew 29% in the year ended March 2025. And the local services group, which includes Ele.me grew 12% with losses significantly narrowing and close to break even. At the end of this article, I will offer a brief value indication for these “hidden assets”.

1. Taobao and Tmall

1.1 Business Model

Taobao and Tmall are the two core pillars of Alibaba's e-commerce empire in China, functioning as vast online marketplaces that cater to different segments of the market.

Taobao is a consumer-to-consumer (C2C) and small business platform. It can be compared to a massive digital bazaar where millions of individual entrepreneurs and small merchants sell a virtually limitless variety of goods, often at highly competitive prices. It's a treasure trove for discovery, known for its wide selection, unique items, and the ability for buyers to interact directly with sellers.

Setting up a basic store on Taobao is free, which attracts millions of small entrepreneurs. Alibaba then monetizes this massive user base by selling them tools to stand out in a crowded marketplace. Key advertising services include:

Pay-for-Performance (P4P) Marketing: This operates much like Google's search ads. Merchants bid on keywords, and their product listings appear in prominent positions within Taobao and Tmall's search results when a user searches for those terms. Sellers pay when a user clicks on their sponsored listing.

Display Advertising: Merchants can purchase banner ads and other promotional spots on various high-traffic pages across the platforms, paying for impressions or a fixed duration. Alimama, which is Alibaba's proprietary marketing technology platform, offers sophisticated tools for merchants to run targeted campaigns across Alibaba's entire ecosystem. It uses the vast repository of user data to help merchants reach their most likely customers based on Browse history, purchase behavior, and demographic profiles.

Tmall (formerly Taobao Mall), in contrast, is a business-to-consumer (B2C) platform designed for established brands and official retailers. It operates like a premium online shopping mall, hosting official storefronts for major local and international brands such as Nike, Apple, and L'Oréal. Tmall guarantees authenticity and offers a more polished, reliable shopping experience, targeting brand-conscious consumers who prioritize quality and official distribution.

Unlike the largely free-to-list Taobao, Tmall is a premium platform for established brands and official retailers. This exclusivity comes with a more structured set of fees, providing a stable and significant revenue stream for Alibaba.

The primary fees for Tmall merchants include:

Annual Fixed Service Fee: Merchants pay a yearly fee to operate their storefront on Tmall. The amount can vary depending on the product category. To incentivize quality and sales volume, Alibaba often refunds a portion or all of this fee if a merchant meets certain pre-agreed sales targets.

Commission on Transactions: This is a crucial revenue driver. For every sale made, Tmall charges the merchant a commission. The commission rate is not flat; it varies significantly by product category, typically ranging from 0.5% to 5%. For example, consumer electronics might have a lower commission rate than apparel.

1.2 Competition and Moat

China's e-commerce market has reached a high level of maturity, with e-commerce accounting for around 27% of the country's total retail sales. Interestingly, that share has stayed about stable for the last 3 years.

In recent years, Alibaba has lost market share to competitors like Pinduoduo and the rapidly growing e-commerce presence of social platforms like Douyin. Despite the intensely competitive environment, Alibaba has managed to grow its China E-commerce revenues 5% in the year ended March 31, 2024 and 3% in the year ended March 31, 2025. In the most recent quarter, revenue growth even re-accelerated to 9% year over year.

Going forward, management is laser focused on stabilizing market share, as they have repeatedly emphasized in the earnings calls. The disappointing results by competitor Pinduoduo are indicative of early success.

Going forward, I believe that Taobao and Tmall will maintain a competitive moat stemming from a multi-layered, self-reinforcing ecosystem that is exceptionally difficult for rivals to replicate. At its core is the unparalleled network effect created by its vast and deep merchant base, with approximately 10 million active sellers offering a breadth of products that vastly exceeds competitors like JD.com, Pinduoduo, or Douyin. This immense product selection consistently attracts over 800 million monthly active users.

Due to its immense scale and the high-purchase intent of its users, Alibaba's platforms offer a foundational and highly effective advertising channel with a consistently strong ROI that merchants rely on for driving sales. While challengers like Douyin may offer superior ROI for specific discovery-based campaigns, Taobao and Tmall's ability to convert active shoppers at scale makes their advertising ecosystem indispensable for brand-building and sales conversion in China.

This, in turn, compels merchants to remain and reinvest their marketing spend, perpetuating a virtuous cycle. This moat is further fortified by a deeply integrated operational stack: Cainiao's logistics network provides reliable next-day delivery reach to over 90% of China's GDP, while Alipay's trusted escrow services and buyer guarantees are critical for minimizing transaction and fraud risks. Furthermore, Alibaba has strategically positioned itself across the entire consumer spectrum, with Tmall anchoring premium brands and Taobao's "Lowest-Price" program directly blunting the discount-focused narrative of its rivals. As an established incumbent, the company has also already adapted to a complex web of regulatory requirements, including antitrust remedies and data localization rules, a hurdle that newer entrants are still navigating. This combination of immense network effects, integrated infrastructure, strategic market coverage, and regulatory maturity creates a deeply entrenched and resilient competitive advantage.

1.3 Business Strategy: Defend Market Share, Increase Take-rate, & AI Innovations

During Alibaba's fiscal year 2025 earnings call, management laid out a clear and pragmatic playbook for its e-commerce business. The strategy is anchored by a guiding mantra from E-Commerce CEO Jiang Fan, who stated, “our top business priority remains stabilizing our market share over the medium to long term”. He stressed that the platform's monetization rate is simply “a reflection of our market share and commercial efficiency”, not the primary objective itself.

The foundation of this strategy rests on reinforcing user loyalty and value. The company continues to “invest in user growth and other strategic initiatives such as price-competitive products, customer service, [and] membership-program benefits” to enhance the user experience. A critical component of this is locking in high-value shoppers through its 88VIP program, which has surpassed 50 million members and continues to see double-digit growth with increasing average revenue per user (ARPU).

With a stable user base as the bedrock, the focus shifts to expanding the monetization base rather than just squeezing existing advertisers. Through new products like Quanzhantui, the company has been able to “monetise sellers who were not effectively reached by traditional advertising tools”. This, combined with the introduction of a new software service fee, has already “provided a short-term boost to our monetization rate”. Management also signaled a clear path to future take-rate expansion, noting that the initial concessions offered to merchants for the new fee will be “gradually phased out”.

To deepen user engagement and increase purchase frequency, Alibaba is making a significant push into a new growth frontier. Viewing “quick commerce as a huge market opportunity” , management considers it a “natural step” to integrate this high-frequency service into the Taobao platform as a new category. This entire multi-pronged effort is underpinned by a commitment to creating a healthy ecosystem, backed by increased support for merchants who provide high-quality products and services.

Beyond the immediate defense of its e-commerce market share, Alibaba's executive team highlighted AI as the central pillar of the company's future, expected to power a "second growth curve" by transforming both its cloud division and its core commerce operations.

Within its own e-commerce business, AI is being applied with a three-pronged objective. First, it offers an opportunity to “fundamentally rebuild traditional algorithm-based systems for search, recommendations, and advertising” , promising immediate improvements in user experience and ad efficiency. Second, as e-commerce is a “labor-intensive industry” , AI is being deployed to boost operational efficiency for both internal teams and the vast community of merchants in the ecosystem. Finally, the company believes AI will “ultimately enable new modes of interaction and innovative user experiences”, which it is now actively exploring. This comprehensive integration of AI underscores management’s conviction that it will be the “key long-term driver for improving user experience and commercial efficiency across the Taobao platform.”

1.4 Financials, Growth Outlook and Valuation

To anchor Alibaba's valuation, I will first isolate the Taobao and Tmall Group (TTG).

Revenue Growth: I project top-line revenue growth at 3% annually from 2025 to 2035. This assumption mirrors the growth rate of the last 12 months. It sits well below most economists' views for China’s nominal GDP growth. It is also well under TTG’s most recent 9% print (for the first quarter of 2025). This slow growth rate thus already bakes in continued market share leakage to rivals like PDD and Douyin. I thus arrive at a next 12 month segment revenue of RMB 464 billion.

EBITA Margins: I assume the EBITA margin remains flat at 44%. This figure is not a heroic expansion but simply the midpoint of the tight 43-45% band the segment has operated in for the past five years, a period that already includes intense competition and couponing.

Bottom-line Earnings: With next 12 month EBITA of RMB 204 billion, I finally load corporate-level share-based compensation, unallocated overhead, and a 20% cash tax rate directly onto TTG, even though other segments would realistically absorb their own share. The result of these assumptions is an expected next 12 month earnings proxy for the segment of RMB 150 billions, expected to grow 3% annually.

Valuation: The next question is what multiple to apply to this conservative earnings stream. As an anchor, the KWEB ETF (KraneShares CSI China Internet ETF) currently has a price to earnings ratio of 17x. In my view, an 18x price-to-earnings (P/E) multiple strikes a sensible balance between recognizing the segment's immense quality and pricing in the real risks of the current environment. A business with a 44% operating margin, a negative working capital cycle, and a high-repeat user base should command a premium to the broader Chinese market.

The bottom line is that by applying a reasonable 18x multiple to a deliberately conservative after-tax profit stream, the Taobao and Tmall segment alone is worth roughly RMB 2700 billion (USD $376 billion).

Importantly, this valuation is derived even while assuming muted growth, flat margins, and full corporate overhead. Any upside from faster-than-expected GDP growth, take-rate gains from AI-driven advertising tools, or exits from unprofitable business segments would flow straight through as a free option.

The market currently values Alibaba at a market cap of RMB 1953 billion (USD 272 billion), or 13x my earnings estimate of the core TTG segment. The current Alibaba share price does hence not only represent a 28% discount to my estimate of the core China e-commerce business value. Moreover, in my view, the market attributes zero value to Alibaba’s cloud computing business, its ANT stake, its cash holdings of RMB 597 billion (US$82 billion), or any of its other business segments, such as Aliexpress, Lazada, or Ele.me.

2. Cloud Intelligence Group

2.1 Why China’s Cloud Adoption Lagged the West

For years, China's public cloud market has been a story of immense potential but puzzlingly slow adoption compared to the West.

In the U.S., cloud adoption took off in the early 2010s as companies sought to replace expensive IT headcount and on-premise infrastructure. In China, the calculus was different: labor was cheap, self-hosted infrastructure was widely subsidized, and many enterprises were years behind on adopting enterprise IT in the first place.

China’s hyperscale cloud also faced a unique regulatory environment. The Cybersecurity Law (2017) and Data Security Law (2021) introduced strict data residency, security reviews, and licensing requirements. These limited the flexibility and speed of adoption—especially for foreign providers, who either retreated or operated through constrained joint ventures.

The table below to put into perspective how far cloud adoption in China is behind the US. If China finally catches up, the potential for the leading players would be enormous, to put it mildly:

2.2 Why China’s Cloud Adoption Might Finally Catch-up

The rise of generative AI now looks to be serving as a powerful catalyst, potentially forcing a generational catch-up. The primary driver is a strategic shift from hesitant adoption to urgent necessity.

“Companies that previously relied on offline IDCs or in-house server rooms are now strongly motivated to migrate to the cloud so as to take advantage of AI…The historic opportunity presented by AI is transforming our entire approach—we are re-architecting our platforms to be AI-driven.”

— Eddie Wu, Alibaba Group CEO, FY25 earnings call, 15 May 2025

From banking to retail, enterprises are racing to shift workloads off in-house servers and onto public-cloud GPU clusters. Moreover, Beijing’s “New Infrastructure” policies now explicitly favour hyperscale cloud providers, and SOEs face mandates to digitise mission-critical systems by 2027.

2.2 Why Alibaba Leads

Alibaba Cloud enters this new cycle as the undisputed market leader, holding roughly 36% share in Q4 2024, about steady for the last three years. Alibaba’s dominance is built on a first-mover advantage. Launching in 2009, it scaled by hosting Taobao, Tmall, Alipay, and DingTalk—all demanding, high-scale tenants. That scale funded early investment in proprietary tech: PolarDB, MaxCompute, and PAI (its AI PaaS).

Its full-stack offering, from proprietary databases to AI platforms, gives it a technical edge that continues to win over the most demanding clients. A recent, powerful endorsement of this leadership came when the Industrial and Commercial Bank of China (ICBC) "officially selected Alibaba Cloud's PolarDB as its enterprise-wide transactional distributed database".

2.3 Winning in the AI Era

Alibaba Cloud is doubling down on AI. Its open-source Qwen LLMs dominate Hugging Face downloads across Chinese and multilingual benchmarks. Developers build with Qwen inside Alibaba Cloud, fine-tune on the same stack, and deploy using the company’s own inference infrastructure—which already powers Taobao and Tmall search, ads, and recommendations.

“We released our next-generation Qwen3 model… By the end of April we had open-sourced over 200 Qwen models, with 300 million downloads and 100 000 derivative models, making it the world’s largest open-source model family.”

— Joe Tsai, Alibaba Group Chairman, FY25 earnings call, 15 May 2025

Meanwhile adoption is broadening from tech giants to every industry & size

“Two clear trends have emerged: AI applications are expanding from internal systems to customer-facing use cases, and adoption is rapidly extending from large enterprises to a growing number of SMEs.” — Eddie Wu, FY-25 call

This signals a much larger total addressable market than the early ‘internet-only’ cohort.

With Taobao and Tmall throwing off RMB 190+ billion in adjusted EBITA, Alibaba can afford to buy GPUs at scale, invest in custom frameworks, and underprice competitors if needed. Perhaps the only competitor in China that can invest in cloud computing in this AI cycle to the same extent is Tencent, but Alibaba is far ahead with its 36% market share vs. Tencent’s 15%.

2.4 Growth Re-accelerates

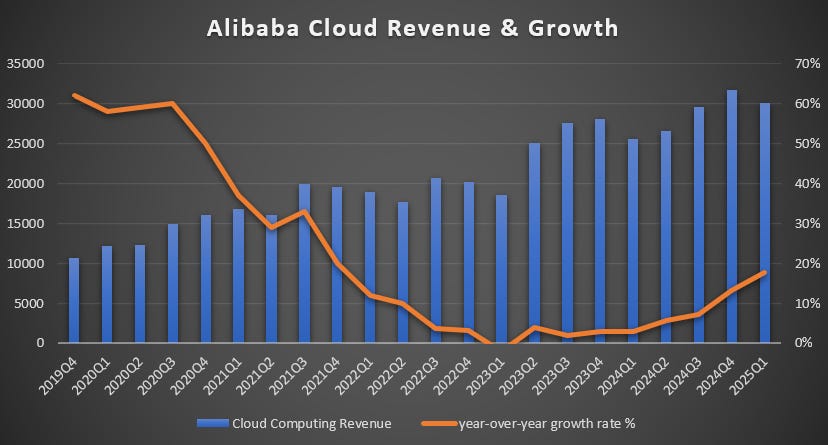

“Cloud revenue grew 18 % year-over-year in Q4 FY25—our strongest pace since 2021.”— Toby Xu, Alibaba Group CFO, FY25 earnings call, 15 May 2025

After a multi-year slowdown, Alibaba Cloud revenue hit RMB 30.1 billion in the March 2025 quarter—its highest level in over two years. Management credited the re-acceleration to:

AI-related revenue growth across PAI and GPU services

Improved public-cloud mix, including elastic compute

The exit of a large low-margin customer (likely ByteDance) now fully behind

Tighter price discipline post-2023 spin-off collapse

“AI-related products have now driven triple-digit growth for seven consecutive quarters.”— Eddie Wu, Alibaba Group CEO, FY25 earnings call, 15 May 2025

Perhaps the single most important figure of this writeup, and a key reason why I invest in Alibaba is the below chart of Alibaba’s quarterly cloud revenue. While the absolute growth alone is remarkable, it still lags significantly the growth investors are used to see by AWS, Azure, or Google Cloud in recent years. Yet, what makes me very optimistic is the orange line, which shows the respective year-over-year growth rate (y-axis on the right). In Q1 2025, Alibaba’s cloud computing growth rate accelerated to 18% and the trendline couldn’t be any clearer.

The world’s AI and investor community is clearly expecting a two-horse race between the USA and China. Given the different starting points, I would not be surprise if China’s cloud computing growth over the next 10 years even exceeds the US. If so, this should work extremely well for Alibaba.

In the next section, I will outline my revenue growth and margin expectations for the next 10 years.

2.4 Projected Cloud Revenue Growth

I have found two recent market studies that project the growth of the Chinese Cloud Computing Market from 2025 to 2030:

Mordor Intelligence projects a CAGR of 18.5%

Grandviewresearch projects a CAGR of 22.9%

At the midpoint of these two studies, the cloud computing market in China would grow at a CAGR of 20%. If Alibaba maintains its market share, it would grow in line with these industry estimates. This seems reasonable to me given Alibaba’s recent acceleration to 18% year-over-year growth.

I use to model my investments on a 10-year basis. For the five years from 2031 to 2035 I assume a CAGR of 15.4%, reaching RMB 717 billion in 2035 (about $100 billion). As a comparison, AWS reached $107 billion in revenues in 2024, while still growing almost 20% a year. Similarly, I would expect that Alibaba can still grow its cloud revenues at least at a low to mid teens growth rate, commanding a respective growth valuation multiple.

2.5 Margins and Valuation

Alibaba’s Cloud segment is profitable and has consistently expanded EBITA margins over the last five years, which resembles the progress we have seen at Alphabet’s cloud segment. EBITA margins have reached 10% at the end of 2024.