Prosus: Gold Standard of Capital Allocation

When a firm trades at a 35 % NAV discount, I perk up my ears. If its assets can compound at high returns for years, I’m even more intrigued. And when that firm then systematically monetizes its discount through value-accretive share buybacks—count me in!

Disclaimer: This write-up is for informational purposes only and is not investment advice.

Prosus: Growing Value Per Share Through Strategic Internet Investments

Prosus is a global consumer-internet investor with a $115 bn market cap and $177 bn NAV. Its sole guiding principle? Grow NAV per share.

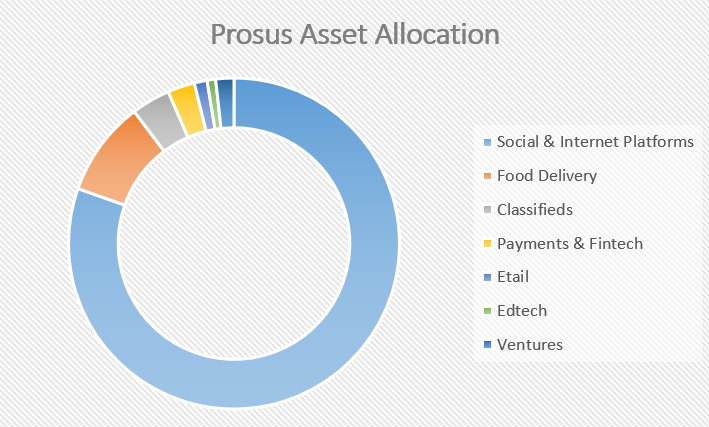

The company invests in and helps grow online platform businesses in promising markets, with a focus on four key areas: Food Delivery, Classifieds, Payments & Fintech, and EdTech. Prosus provides capital and strategic advice to local entrepreneurs, leveraging its global experience to adapt successful business models locally.

Prosus takes a long-term approach, aiming for sustainable growth and strong local market positions. Its strategy follows a simple pattern: invest in promising companies, scale them effectively, and eventually realize value through strategic sales or partnerships.

Active management of its portfolio is central to Prosus’s strategy. The firm regularly reviews its investments to decide whether to increase support or sell assets to maximize returns. Moreover, Prosus carefully manages its share count through buybacks, especially when its shares trade at discounts to NAV. This directly boosts NAV per share, aligning perfectly with its core strategy of maximizing shareholder value.

Components of Asset Value

Prosus’s portfolio remains heavily dominated by Tencent, the Chinese internet giant, which accounts for 80% of its NAV. For investors uncomfortable with Tencent or those avoiding Chinese investments altogether, Prosus might not be suitable. However, I believe Tencent itself is a compelling investment and Prosus is a superior way to play it, given the NAV discount and its active exploitation (more details follow below). Furthermore, investors should expect that the Tencent share becomes less dominant over time as Prosus uses primarily Tencent sales to finance share buybacks and new investments.

Prosus Investment in Tencent (80.4% of NAV)

Ecosystem

Tencent has created a vast digital ecosystem that integrates communication, social media, entertainment (games, video, music, literature), financial services, cloud computing, and essential mobile utilities, often all accessible through its super-app WeChat. It holds a #1 position in China by users and revenue in many of these segments.

Growth

As a result, Tencent’s revenue sources are pretty well diversified. And despite its massize size, Tencent’s revenue growth has been accelerating to 13% year-over-year according to its Q1 2025 results.

Interestingly, Tencent’s operating margins are also expanding:

Tencent is currently trading at price-to-earnings ratio of 17.7 on 2025 expected earnings (22% growth over 2024 EPS). This P/E ratio strikes me as undemanding for a firm as dominant as Tencent and that is likely to grow earnings >10% p.a. for the foreseeable future.

Tencent’s China Fund

Importantly, Tencent is free of (net) debt. In contrast, as of 31 March 2025, Tencent’s balance sheet carries roughly USD 91 bn of fair-value stakes in listed companies and USD 47 bn in unlisted businesses. Together, these investments represent 23% of Tencent’s entire market cap. Tencent has repeatedly spun out investments to its shareholders (e.g. JD.com). Netting out the current value of these investments, the 2025 PE of Tencent would only be 13.6.

As an indirekt Tencent shareholder, I am however more than happy for Tencent to keep investing. These are not merely passive holdings; Tencent actively manages these investments much like a highly specialized China-tech private-equity fund. It leverages its unparalleled real-time data on user behaviour, monetization strategies, and product engagement to identify and cultivate high-potential companies. The true power of this model, however, lies in the profound network effect: investee companies gain privileged access to Tencent’s vast user base, extensive distribution channels, cutting-edge cloud infrastructure, and ubiquitous payments ecosystem. This strategic integration accelerates their growth, significantly reduces customer-acquisition costs, and fosters a virtuous circle of value creation that is exceptionally difficult for standalone competitors to replicate.

Tencent currently massively invests in cloud computing, a promising future growth lever. Nevertheless, Tencent is also repurchasing shares. Currently at an annualized pace of about 1.5%.

Tencent Return Expectations

Taken together, Tencent is trading at a PE ratio that is asking for multiple expansion, not multiple compression. It is growing revenues at 13% and accelerating. At the same time margins are expanding. Plus, the firm is buying back shares. Taken together, I don’t think it is overly agressive to assume that Prosus’ Tencent investment can compound at a CAGR of 15% over a mid term horizon (3-5 years). And this case does not even ask for multiple expansion or the market recognizing the value of Tencent’s listed and private investments - a scenario that could bring the CAGR closer to 20%.

Prosus E-Commerce Investments (19.1% in total)

Prosus’s non-Tencent portfolio is no mere footnote. It spans multiple e-commerce segments including food delivery, classifieds, fintech, education tech, and other growth-oriented ventures. Prosus’s annual reporting sums up its non-Tencent portfolio under “E-commerce” and this is also the terminology used by the CEO in his annual letters.

“In October, I set a goal of delivering $400 million in aEBIT for our ecommerce portfolio in FY 2025. I am very happy to say we have exceeded our goal and will report more than $435 million for the year. For FY 2026, I want to achieve at least the same level of incremental aEBIT.” Fabricio Bloisi, CEO (letter to shareholders on May 8, 2025.

On a consolidated basis, Prosus entire E-commerce investments have only become profitable in the financial year 2024. For 2026, their investments reached an EBIT of $435 million and will reach $500 million soon. This is a solid level of profitability given that Prosus’ E-commerce investments are majority unlisted (about 2/3s). The total NAV contribution of these firms is $33.4 bn USD.

In the following I split up Prosus E-commerce holdings into its segments and briefly address major investments.

Food Delivery (8.9%)

Meituan (2.6%): Prosus holds a direct ~4 % stake (257 million shares) received via Tencent’s November 2022 spin-off dividend; Meituan is China’s dominant food-delivery and local services platform with over 65 % market share. Meituan grew revenues 22% in 2024 and is trading at a forward PE of 16x, which I view as a compelling setup.

Swiggy (1.3%) - ca 38% stake: India’s largest food-delivery and quick-commerce player, holding roughly 42 % of the market against Zomato’s 58 %. Prosus has cashed in $2.4 bn when Swiggy listed this year.

Delivery Hero (1.3%) - ca 28% stake: A top-five global food-delivery operator with €48.8 bn GMV and €12.8 bn revenue in FY 2024, serving over 70 countries. Key markets where its brands have a significant or leading presence include South Korea (Woowa Brothers/Baedal Minjok), Türkiye (Yemeksepeti), various countries in the MENA region (Talabat, HungerStation), and numerous nations across Europe (Glovo, Foodora)

iFood: Prosus’s fully owned Brazilian platform commanding over 70 % of Brazil’s meal-delivery market and 57 % of the broader delivery sector.

Prosus’s food delivery segment is about to become even bigger. In May 2025, Prosus launched a recommended all-cash takeover offer for Just Eat Takeaway.com at €20.30 per share (or €4.06 per ADS), representing a 63 % premium to JET’s February closing price and valuing the business at roughly €4.1 bn. The deal, unanimously recommended by JET’s boards, kicks off a tender period from 20 May to 29 July 2025 and is expected to close by year-end. Prosus sees the acquisition as a chance to build a Europe-based food-delivery champion—applying proven AI-driven efficiencies from iFood, expanding JET’s product, technology and logistics capabilities, and harnessing Prosus’s global scale to accelerate growth while delivering immediate, certain value to JET shareholders.

JET holds leading market positions in many of its operational countries, particularly in key profitable markets like the United Kingdom & Ireland, Germany (as Lieferando.de), and the Netherlands (as Thuisbezorgd.nl). They also have a strong presence in Canada with SkipTheDishes and Australia with Menulog, and generally command a significant online food delivery share in their #1 European markets.

Classifieds (3.7%)

Prosus’s Classifieds portfolio spans both fully consolidated and equity-accounted businesses, anchored by its OLX platform in 19 core markets. The flagship OLX Europe ecosystem operates horizontal marketplaces and verticals in automotive and real-estate across eight countries (14 million DAU, 62 million daily listings), while OLX South Africa and the 50 % JV OLX Brasil extend its reach in those regions. Over the last year, Prosus has exited its OLX Autos unit and redeployed capital into higher-growth segments. Beyond these core markets, Prosus holds leading minority stakes in OfferUp (38.8 % in the US), Dubizzle (37.6 % in the UAE) and France’s Selency (26.3 %), plus smaller vertical plays like Fixly and Carsmile . In FY 2024, the Classifieds segment generated US $951 million of revenue (up 26 % YoY) and US $187 million of trading profit (20 % margin), driven by effective cost control, tech-enabled trust and safety measures, and the roll-out of transaction services—from pay-and-ship to online bookings and car-loan facilitation .

Payments & Fintech (2.2%)

Prosus’s Payments & Fintech segment (via its PayU platform and associated businesses) delivered US$1.3 bn of revenue in FY 24—up 24% YoY on an economic-interest basis—and narrowed its trading loss to US$59 million (a 49% improvement) .

At its core sits PayU, which processed US$119 bn of payments volume in 20 high-growth markets. Within that:

Core PSP (payment-service-provider) revenue reached US$975 million (+23%), generating a US$19 million trading profit (2% margin) through operations in India, Turkey (Iyzico) and other GPO markets .

PayU’s credit arm grew its loan book to US$468 million, issuing US$873 million in loans (up 29%), with revenue of US$107 million and continued investment to scale merchant lending ﹘ losses widened modestly as it builds for future returns .

Beyond PayU’s subsidiaries (100%-owned PayU India, Red Dot Payment, Iyzico, Wibmo), Prosus holds a 19.8% stake in Remitly—a digital-remittance leader that grew revenue 44% to US$944 million and achieved a positive 5% adjusted EBITDA margin.

Together, these businesses position Prosus to capture the accelerating shift to digital payments and credit in emerging markets—especially India, where digital transactions are projected to quadruple by FY 30—and to expand value-added services across merchants, consumers and banks.

Etail (1.3%)

Prosus’s Etail arm is anchored by eMAG, the leading online marketplace in Central & Eastern Europe. In FY 24, eMAG generated US $2.2 bn of revenue (up 14 % YoY) and narrowed its trading loss to US $36 million (a 2 % loss margin), driven by robust growth in Romania and early profitability in its logistics (Sameday) and grocery (Freshful) extensions . With over 8 ,000 employees, eMAG has built a multi-category ecosystem—spanning electronics, fashion (Fashion Days), food delivery (Tazz) and grocery (Freshful)—all unified by its “Genius” loyalty subscription and an expanding network of courier lockers .

EdTech (0.7%)

Prosus’s EdTech segment spans a portfolio of 12 digital-learning businesses and generated US $444 million of revenue in FY 24 (down 19 % in US$, organically up 7 %), while cutting trading losses by 69 % to US $80 million . Key holdings include Stack Overflow (US $98 million revenue; launching OverflowAI co-pilot APIs), GoodHabitz (€50 million revenue; 25 % growth) and a 37.9 % stake in Skillsoft (flat revenue, 19 % EBITDA margin) . The segment is focused on embedding GenAI tutors, expanding into K-12 and workforce-skilling markets, and leveraging Prosus’s AI team to improve personalised learning.

Ventures (1.7%)

Under “Other Ecommerce,” Prosus Ventures acts as its early-stage tech investor. In FY 24 the Ventures arm recorded US $556 million of revenue (down 10 %) and US $129 million of trading losses (down 52 %), with a lean team of 585 focused on large-TAM, software-enabled businesses . Over the year, Ventures deployed US $140 million across more than 20 new deals—doubling down on high-conviction areas like GenAI, fintech and vertical-specific SaaS in growth markets—while building a pipeline for its next wave of investments.

What Returns May Prosus’s Asset Portfolio Generate?

In sum, Tencent is about 80% of the portfolio, where I am expecting a return of about 15% p.a. The remaining 20% of Prosus are diversified across listed assets (5.8%) trading at partly very reasonable valuations (e.g. Meituan), as well as unlisted assets (13.3%) and some net cash (1.4%). In total, it feels like 10% p.a. is a reasonable expected return for a portfolio diversified across listed tech companies, mostly later stage private equity investments and a small portion of more venture capital type moonshots. The weigthed average return for the entire Prosus portfolio would be 14% p.a.

An expected return of 14% p.a. is pretty compelling. Yes, there is some bulk risk with Tencent. On the other hand, Tencent is perhaps the single best China investment that is available in the market for a broad range of investors. There is no ADR de-listing risk, as Tencent always traded only in Hong Kong. Perhaps it is still not unwise to have some China allocation. Tencent itself has well-diversified business segments and a rock-solid financial structure. And 23% of its market cap are a best in class crossover of an actively managed tech fund and a venture capital fund. This seems to me a reasonable way to get China investment exposure.

That said, I would not invest in Prosus alone for its asset portfolio. While attractive, I think I can achieve higher than 14% p.a. expected returns elsewhere. What makes Prosus an attractive investment that ended up in my portfolio is its NAV discount and particularly the way it deals with it.

When the Markets Hand you an NAV Discount - Exploit it!

There are many firm that aim to grow NAV. There are many firms that trade at often substantial NAV discounts. Some of these firms occassionally launch share buybacks (e.g. Softbank). But according to my knowledge, there are very few firms that trade at a big NAV discount while substantially and consistently buying back shares.

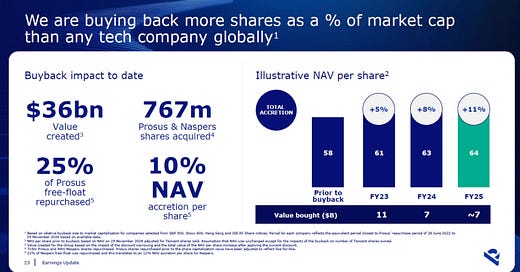

On June 27, 2022 Prosus announced an open-ended share repurchase programme. Prosus Investor Relations website states: As of 29 November 2024, the buyback has created over US$36bn in value. It achieved a 10% NAV accretion per share while 25% of Prosus free float has been repurchased.

How precisely did the share buyback program achieve a 10% NAV accretion or create any value when Prosus’s NAV discount has basically gone nowwhere? Did Prosus create money out of thin air? After all we are talking about an extra ~4% of return p.a.

The Arithmetics of Share Buybacks at a Discount & NAV Accretion

Here is the formula for NAV per share accreation as a function of the discount (d) and the annual % of reduction in the share count (x):