Portfolio Q4 2022

Q3 is over, the performance of the modernvalueinvesting portfolio was -3.9%. During the past three months, the global macro situation has significantly worsened. The FED, which long held the view that “inflation is transitory,” has run out of patience. It has kept raising rates 75 basis points each meeting and changed its rhetoric to “pain” and guides for ongoing interest rate increases. I believe the FED is making a fatal error. Most prices are already falling off a cliff since June. The CPI ex shelter is already down. The problem with the (core) CPI is that housing and rents enter the equation in a lagged way. However, it is clear that house prices are also already falling since June and at least since September rents are also falling. In sum, we are already observing price deflation.

I expect pressure on the FED to reverse its hawkish policy will heat up over the next months. I expect at the very least a change in rhetoric already in Q4, even if the FED may still go ahead with one more raise of 75 basis points in November. If it does that, I think the FED funds rate will peak in Q1 and will be reduced afterwards. At this point, the official CPI should be negative by June 2023, which would at the latest enforce a significant pivot by the FED starting in H2 2023. If I am right, I expect the market will anticipate these developments much earlier as compared to the actual actions implemented by the FED.

I acknowledge it could come worse and inflation may be more sticky. But even if I am right, the FED’s interest rate shock has already caused significant harm to financial markets: banks, real estate, bond investors, and companies reliant on debt financing. The longer the FED maintains this level of interest rates, the more severe the problems caused. Accordingly, I have positioned my portfolio more conservatively, but without giving up much upside.

I have sold out of my 9% position in Carvana during Q3 at relatively favorable prices. I have reduced Auto1 Group from 9% to a 4%, and I have also sold my position in Amazon (12%). Amazon is very attractive, but it does not hold up with the other opportunities I see in this market. Moreover, I feared that Amazon may have significant short term downside if this bear market continues, whereas other e-commerce stocks already trade at rock bottom levels today.

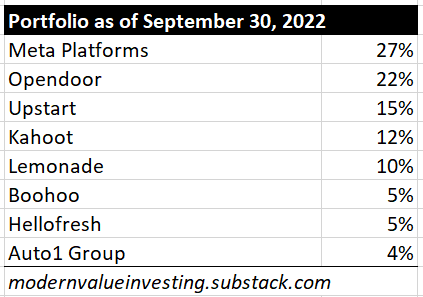

In turn, I have significantly increased my position in Meta Platforms, which now makes 27% of the portfolio. I have increased my position in Kahoot to now 12% of the portfolio. Moreover, I have initiated new positions in Boohoo (5%) and HelloFresh (5%), which both generate substantial levels of cash flow, especially relative to their market capitalizations. Here is the complete portfolio going into Q4 2022:

The portfolio can be broadly classified into three segments:

Cash Flow Positive (49%): Meta, Boohoo, and HelloFresh, Kahoot

High growth, break-even cash flow (15%): Upstart

High growth, negative cash flow (36%): Opendoor, Lemonade and Auto1

Below I discuss why I feel comfortable with this portfolio going forward even if the FED (is forced to) continue its hawkish interest rate policy for longer: