Match Group: Dominant Online Dating Platform at Trading at a Value Multiple

A MATCH Made in Heaven for Value Investors?

Disclaimer: This writeup is not investment advice. I am sharing my research insights and positioning on individual companies for informational and entertainment purposes. In particular, I do not take into account any reader’s personal financial situation. Please do your own research.

Summary

Business Model: A Dominant Platform of Online-Dating Apps

Strong Margins & Substantial Buybacks

Valuation: What it takes for a 20% CAGR

Match Group: A Dominant Leader in the Online Dating Market

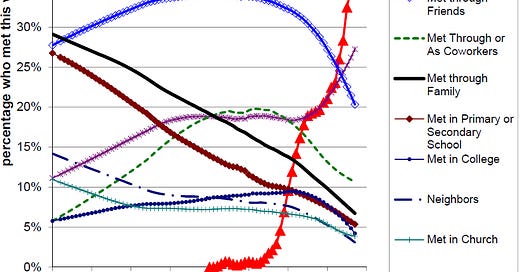

Just as the internet has revolutionized numerous aspects of daily life, it has similarly transformed the dating market. A study published in the Proceedings of the National Academy of Sciences provides clear data illustrating this shift. The graph below from the study shows that online dating has become the dominant method for couples to meet, overtaking traditional avenues in the early 2000s and continuing to grow in prevalence.

According to a recent Forbes survey, online dating continues to play a pivotal role in modern social interactions. Over 40% report that online dating has simplified the process of finding a date, highlighting the widespread acceptance and positive attitudes toward this method of meeting new people. 45% of respondents consider dating apps the most effective way to find dates, outperforming traditional methods like meeting through friends or at social events.

Within this thriving market, Match Group is the dominant provider of online dating services. The company operates five of the eight most popular platforms in the United States—Tinder, Hinge, Plenty of Fish, OKCupid, and Match—collectively accounting for a substantial 65.6% share of all dating app downloads in the region. This market leadership is emphasized by the comparison with its main competitor, Bumble, which has a much smaller payer base of 4 million compared to Tinder's 10 million, as per the most recent quarterly reports.

Overview and Business Model

Match Group has demonstrated consistent topline growth from 2019 to 2023, indicating robust performance and strategic expansion across its various brands. In 2023, the company achieved a total revenue of $3.365 billion, marking a 6% increase from the previous year. This growth is segmented into several key areas: Tinder, Evergreen & Emerging brands, Hinge, and the Asia market.

1) Tinder

2023 Revenue: $1.918 billion, accounting for 57% of Match Group's total revenue.

Q1 2024 Revenue Growth: +9% (+12% FX Neutral), further improving monetization.

Tinder, as the flagship platform of Match Group, has fundamentally transformed online dating with its quick setup process, engaging Swipe feature, and strong word-of-mouth promotion. These innovations spurred viral global growth, establishing Tinder as the leader in the dating app category with about 50 million monthly active users (MAUs) across 190 countries and 45+ languages. However, recent quarters have seen pressures on both its user and payer bases, attributed partly to strategic decisions including enhanced trust and safety efforts and the exit from two countries. Despite these challenges, Tinder is actively working to rejuvenate growth and anticipates positive sequential payer net additions along with a slowdown in user declines later in the year.

To drive this turnaround, Tinder has set four priorities: redefining dating for the next generation, winning back women, enhancing monetization optimization and localization, and building a widely loved brand. Measures taken have included updating community guidelines and moderation practices to improve the quality of its ecosystem, which, despite contributing to a decline in MAUs, have enhanced the overall product experience and authenticity scores. Additional safety initiatives like the “Share My Date” feature and upcoming requirements for face photos aim to further bolster user trust, especially among women.

Despite these user-related challenges, the primary focus for investors should remain on Tinder's revenue growth and its potential for increased monetization. Through strategic pricing adjustments, including the introduction of weekly subscriptions and expansion of à la carte features, Tinder has shifted its strategy from merely boosting user numbers to enhancing user value extraction. These initiatives have successfully raised the revenue per user, suggesting that Tinder's approach is effectively aligned with both improving user engagement and driving significant revenue growth—a critical metric for evaluating the company's long-term financial health.

2) Hinge

2023 Revenue: $396 million, accounting for 12% of Match Group's total revenue.

Q1 2024 Revenue Growth: +50% further improving monetization.

Hinge is quickly emerging as a star within the Match Group portfolio, demonstrating significant growth potential and rapidly expanding its user base. As a platform that prides itself on being "designed to be deleted," Hinge has cultivated a strong brand identity centered on serious, intentional dating. This positioning has resonated well in core English-speaking markets and has begun to make significant inroads in European expansion markets. With over 10 million monthly active users (MAUs), Hinge is on track to generate more than half a billion dollars in direct revenue in 2024, marking it as one of the top three most downloaded dating apps in all 17 of its target markets during the first quarter.

Marketing efforts have been instrumental in driving this growth, with Hinge's fifth "Designed to be Deleted" campaign leveraging real user success stories to enhance its brand appeal. Match Group is confident to grow hinge to becoming a $1 billion revenue business. Strategies to achieve this milestone include expanding into new markets, enhancing user acquisition in existing ones, and introducing new monetization features that are consistent with the unique Hinge user experience.

Hinge is also committed to enhancing user safety and outcomes through continuous product innovation. A notable feature, Hidden Words™, allows users to filter out unwanted words, phrases, or emojis from incoming messages, thus enhancing communication safety. Additionally, the integration of AI technology across various facets of the user journey—from assisted profile creation and improved matching algorithms to features that promote responsiveness in communications—underscores Hinge's dedication to refining the dating experience. This comprehensive approach aims not only to grow the user base but also to increase the proportion of paying users, capitalizing on the platform's high engagement levels to boost overall revenue.

3) Evergreen and Emerging Brands

2023 Revenue: $691 million, accounting for 20.5% of Match Group's total revenue.

Q1 2024 Revenue Growth: -4%